Understanding Islamic Finance: A Guide from CEDS Finance

At CEDS Finance, we’ve helped hundreds of Muslim business owners navigate the complexities of Islamic finance while growing their businesses in America. Through these partnerships, we’ve learned that clarity and education are essential first steps. Whether you’re expanding your halal restaurant, launching a new retail store, or investing in equipment for your service business, understanding the foundations of Islamic finance is crucial. Let’s explore the key concepts that will help you make informed decisions about Sharia-compliant financing.

Introduction to Islamic Finance

Islamic finance varies significantly depending on location, country, and even neighborhood. This is due to different schools of thought in Islamic jurisprudence. At the core of Islamic finance is Sharia law, the divine law for Muslims based on the Quran and the Sunnah (the practices of Prophet Muhammad). Below Sharia law is Islamic jurisprudence, the human interpretation of divine law, leading to varying practices across the world.

The Role of Islamic Jurisprudence

There are four or five major schools of thought in Islamic jurisprudence, each with millions of followers. For instance, Afghanistan follows the Hanafi school for legal matters. Consequently, a practice compliant in one place might not be in another. In the U.S., the Office of the Currency Controller approves certain Islamic finance products, making them legal and regulated. Locally, scholars also review and approve these products.

What is Murabaha Financing?

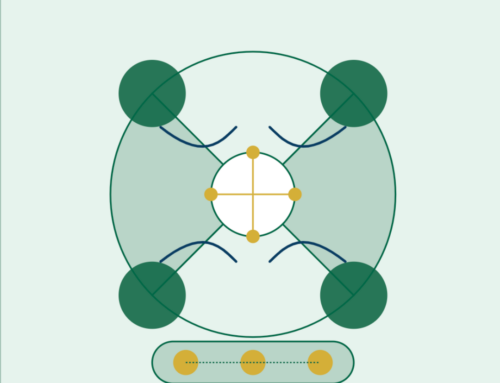

Murabaha is an Islamic loan structure that constitutes about 80% of Islamic finance products. It involves two main components: a cost amount and an admin fee (profit). Both must be transparent and agreed upon in advance. The admin fee must be fixed and cannot change over time. The bank buys an asset and then sells it to the buyer at a profit, avoiding the prohibited practice of making money from money (interest).

Key Points of Murabaha

- The bank must own the asset before selling it to the buyer.

- All costs and profits are agreed upon in advance, ensuring transparency.

- Different regions may interpret these rules differently, but transparency and consultation with local scholars can help navigate these differences.

Taking the Next Step with CEDS Finance

At CEDS Finance, we’re committed to providing clear, compliant financing solutions that align with your values and business goals. Our team works closely with Islamic scholars and regulatory bodies to ensure our products meet both religious and legal requirements. If you’re ready to explore Sharia-compliant financing options for your business, we’re here to guide you through every step of the process. Contact us today to learn how we can help your business grow while staying true to your principles.